All Categories

Featured

Table of Contents

- – Expert-Driven Private Equity For Accredited In...

- – Turnkey Accredited Investor High Return Invest...

- – World-Class Accredited Investor Funding Oppor...

- – Reliable Accredited Investor Investment Netwo...

- – Market-Leading Accredited Investor Wealth-bu...

- – High-Value Accredited Investor Funding Oppor...

- – Reputable Accredited Investor Investment Net...

The guidelines for accredited investors vary among territories. In the U.S, the meaning of a certified capitalist is presented by the SEC in Regulation 501 of Regulation D. To be a recognized financier, an individual must have a yearly earnings exceeding $200,000 ($300,000 for joint income) for the last 2 years with the expectation of gaining the exact same or a higher earnings in the present year.

A recognized capitalist needs to have a total assets going beyond $1 million, either independently or jointly with a spouse. This amount can not consist of a primary home. The SEC also thinks about applicants to be recognized capitalists if they are basic companions, executive officers, or directors of a firm that is issuing unregistered safeties.

Expert-Driven Private Equity For Accredited Investors

Likewise, if an entity contains equity owners who are recognized financiers, the entity itself is a recognized investor. However, a company can not be formed with the sole purpose of acquiring details safeties - accredited investor high return investments. An individual can certify as an accredited financier by demonstrating sufficient education or task experience in the economic sector

People who want to be certified financiers don't put on the SEC for the designation. Rather, it is the obligation of the firm using a private placement to make certain that all of those come close to are accredited capitalists. People or parties that desire to be approved capitalists can come close to the provider of the non listed safeties.

Suppose there is a private whose earnings was $150,000 for the last three years. They reported a main house value of $1 million (with a home mortgage of $200,000), a car worth $100,000 (with an impressive lending of $50,000), a 401(k) account with $500,000, and an interest-bearing account with $450,000.

Total assets is computed as properties minus responsibilities. He or she's internet worth is exactly $1 million. This includes a calculation of their possessions (other than their primary house) of $1,050,000 ($100,000 + $500,000 + $450,000) less an auto loan amounting to $50,000. Considering that they satisfy the total assets need, they qualify to be a certified investor.

Turnkey Accredited Investor High Return Investments

There are a few less common certifications, such as managing a depend on with even more than $5 million in possessions. Under government safety and securities regulations, just those who are accredited capitalists might join certain securities offerings. These may consist of shares in private placements, structured products, and private equity or hedge funds, amongst others.

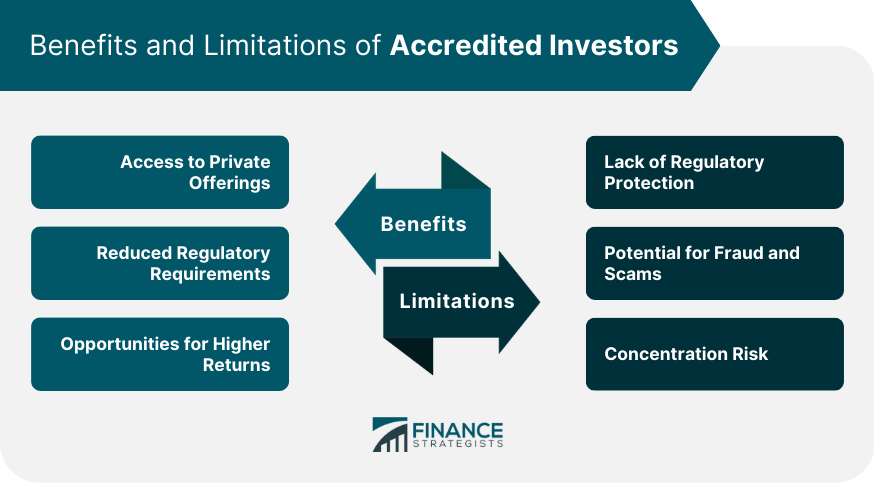

The regulators intend to be certain that participants in these extremely dangerous and complicated investments can fend for themselves and evaluate the threats in the absence of federal government defense. The certified financier policies are designed to safeguard prospective financiers with restricted economic understanding from risky endeavors and losses they may be sick outfitted to stand up to.

Recognized financiers satisfy certifications and expert requirements to access unique financial investment possibilities. Approved investors have to satisfy revenue and web well worth requirements, unlike non-accredited individuals, and can invest without limitations.

World-Class Accredited Investor Funding Opportunities

Some key adjustments made in 2020 by the SEC include:. Consisting of the Collection 7 Collection 65, and Series 82 licenses or various other qualifications that reveal monetary knowledge. This modification acknowledges that these entity types are commonly utilized for making investments. This modification recognizes the know-how that these staff members develop.

This change accounts for the impacts of inflation in time. These modifications broaden the certified financier swimming pool by roughly 64 million Americans. This wider accessibility supplies extra opportunities for capitalists, yet additionally enhances possible dangers as less monetarily sophisticated, investors can take part. Businesses making use of private offerings may gain from a bigger pool of prospective financiers.

These financial investment alternatives are exclusive to certified investors and establishments that certify as an approved, per SEC policies. This offers recognized financiers the opportunity to spend in emerging companies at a phase prior to they take into consideration going public.

Reliable Accredited Investor Investment Networks for Consistent Returns

They are checked out as investments and come only, to certified clients. Along with recognized companies, certified capitalists can pick to buy start-ups and up-and-coming ventures. This provides them income tax return and the chance to go into at an earlier stage and potentially gain rewards if the company prospers.

Nonetheless, for financiers open up to the dangers included, backing start-ups can bring about gains. Several of today's tech business such as Facebook, Uber and Airbnb originated as early-stage startups sustained by approved angel financiers. Innovative financiers have the chance to discover investment alternatives that might yield extra profits than what public markets provide

Market-Leading Accredited Investor Wealth-building Opportunities

Returns are not guaranteed, diversification and profile improvement choices are broadened for financiers. By expanding their profiles via these expanded financial investment opportunities recognized capitalists can enhance their strategies and potentially accomplish superior long-term returns with appropriate threat administration. Experienced capitalists usually run into investment options that may not be quickly readily available to the basic investor.

Investment options and protections provided to recognized capitalists typically include higher dangers. For instance, personal equity, venture funding and bush funds often concentrate on purchasing possessions that lug threat but can be sold off easily for the possibility of higher returns on those high-risk financial investments. Investigating before investing is important these in circumstances.

Lock up durations protect against investors from taking out funds for more months and years on end. Financiers might battle to accurately value exclusive possessions.

High-Value Accredited Investor Funding Opportunities

This modification may prolong certified capitalist condition to a range of people. Allowing partners in dedicated partnerships to incorporate their sources for shared eligibility as accredited investors.

Allowing people with certain professional certifications, such as Collection 7 or CFA, to qualify as certified capitalists. Developing added demands such as proof of financial literacy or effectively completing an approved financier exam.

On the various other hand, it could additionally lead to seasoned investors assuming too much risks that might not be suitable for them. So, safeguards might be required. Existing recognized financiers may encounter increased competition for the ideal investment opportunities if the pool grows. Companies elevating funds might gain from a broadened recognized investor base to draw from.

Reputable Accredited Investor Investment Networks

Those who are presently thought about accredited financiers must stay upgraded on any type of changes to the criteria and guidelines. Their qualification could be subject to alterations in the future. To preserve their condition as certified investors under a revised definition adjustments may be necessary in wealth management methods. Companies looking for recognized financiers ought to remain alert concerning these updates to guarantee they are bring in the right target market of capitalists.

Table of Contents

- – Expert-Driven Private Equity For Accredited In...

- – Turnkey Accredited Investor High Return Invest...

- – World-Class Accredited Investor Funding Oppor...

- – Reliable Accredited Investor Investment Netwo...

- – Market-Leading Accredited Investor Wealth-bu...

- – High-Value Accredited Investor Funding Oppor...

- – Reputable Accredited Investor Investment Net...

Latest Posts

Delinquent Property Tax Auction

Tax Lien Investing In Canada

Free Tax Lien Property List

More

Latest Posts

Delinquent Property Tax Auction

Tax Lien Investing In Canada

Free Tax Lien Property List